Buying property in Dubai has become a dream for a large number of real estate investors across the globe. In fact, not just investors but also expats who have moved to Dubai for better employment opportunities would love to have their own homes in Dubai.

However, not everyone has enough money upfront to buy a property in Dubai. That is why a large number of buyers turn to mortgages in Dubai. Another major problem for buyers is how to make the down payment.

The question stands: can you buy property in Dubai without down payment? Well, it is not possible to answer this question in a single line. So, here is what you need to know about how to buy property in Dubai without down payment.

What is a Down Payment?

A down payment is the amount of money you pay right away when buying a property. When you agree to buy, you need to pay a certain percentage of the total cost upfront. This initial payment is called a down payment. It reduces the risk for the lender and gives you some ownership of the property from the start. In Dubai, if you’re buying real estate, expats need to make a down payment of 20%, while locals need to pay 15%.

Benefits of Buying Property in Dubai Without Down Payment

Buying property in Dubai without a down payment is beneficial because of

Lower Upfront Cost

The fact that you do not need a large sum of money to start buying property, makes it possible to own property without saving a massive amount first.

Faster Market Entry

You can get into the Dubai property market quickly and potentially benefit from any increase in property values while you save for a down payment.

Drawbacks of Buying Property in Dubai Without Down Payment

There is a negative side to buying property in Dubai without a down payment.

Higher Monthly Payments

Without a down payment, your monthly mortgage payments will be higher.

Financial Strain

Make sure you can handle not just the mortgage payments but also the ongoing costs of maintaining the property.

Can You Buy Property in Dubai Without Down Payment?

Buying a property without a down payment is not possible. However, there are alternative methods available for buying a property if you don’t have the necessary funds for a down payment.

In Dubai, acquiring a property, whether through a mortgage or otherwise, typically requires a down payment. The bank will only transfer funds to the developer or owner for property payment after you have provided proof of your down payment.

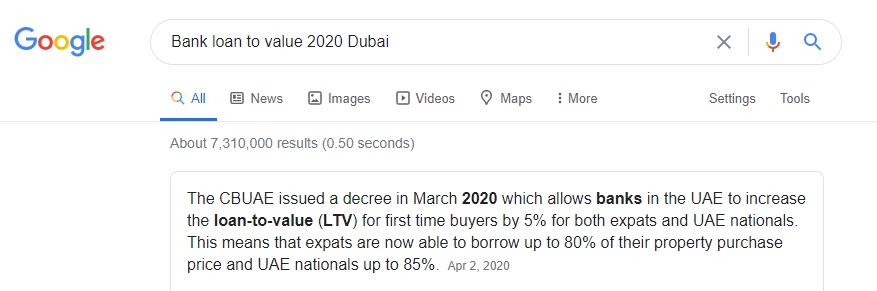

In 2020, The UAE Central Bank increased the LTV ratio, which other banks followed as well. That means the minimum down payment is 20% for the expats and 15% for UAE nationals. Yes, the minimum down payment percentage has decreased, but the down payment is still mandatory.

However, the good thing is that there are ways (other than a mortgage) that you can use to make down payments. These methods can help you pay for buying luxury properties as well. (While considering these alternative financing methods, exploring a range of available properties can help you better understand what Dubai has to offer. You can checkout real top Luxury real estate websites in Dubai such as Orchid Homes Real Estate, Luxhabitat, Sotheby’s International Realty, etc.)

Let’s discuss how you can buy property in Dubai without down payment.

8 Ways How to Buy Property in Dubai Without Down Payment

You can consider the following options to address the down payment requirement even if you don’t have funds.

1. Obtain a personal loan

A Personal Loan differs from a Home Loan (Mortgage) in that it can be obtained for various purposes, including covering a down payment.

Personal loans typically have a lower borrowing limit compared to mortgages and usually need to be repaid within a maximum of around four years (with some flexibility depending on the bank).

It is important to note that you cannot simultaneously take out a personal loan and a home loan from the same bank under your name.

If you are managing the process independently, you might consider taking out a personal loan initially to cover the down payment amount.

2. Lookout for lease-to-own properties

Some developers or property owners provide lease-to-own or rent-to-own agreements. It is a process in which a portion of the rent payments contributes to building equity in the property.

Tenants/Renters may later have the option to purchase the home, utilizing the accumulated equity as a down payment. This approach is often highly attractive to many families looking to own property in Dubai.

3. Use your non-cash assets

Developers or sellers may sometimes accept non-cash assets instead of a cash down payment. These assets could be exchanged for a reduced financial down payment and may include valuable items, properties in different locations, or services.

4. Negotiate a lower down payment

Negotiating a lower down payment is another possible option. You can negotiate with the seller or developer to reduce the initial payment requirement. However, completely avoiding a down payment may be challenging. Some developers may offer special packages with lower down payment percentages during specific times.

5. Property exchange

If you are an owner of a property or have a sizable equity position in another property, you can explore the option of exchanging it for the property you want to buy in Dubai. This property exchange transaction will allow you to avoid making a cash down payment.

6. Partnerships and joint ventures

Another option to consider is forming joint ventures or partnerships with other investors or individuals to purchase a home. This strategy can reduce the need for individual down payments and distribute the financial burden among multiple parties.

7. Developer payment plans

Some developers offer attractive payment plans with extended post-handover options. It allows customers to pay down payments in installments over a longer period after completion of the property. This can help buyers manage their cash flow more effectively.

8. Use existing investments

You can also consider using your existing investments, such as stocks, bonds, or other liquid assets, to make the down payment. However, it is important to consult a financial advisor before proceeding. That is because selling investments can carry tax implications that you must consider carefully.

Final words

You can turn your dream of buying property in Dubai into reality even if you don’t have enough funds for the down payment. The above-mentioned options can help you buy property in Dubai without down payment.

You can also consider consulting registered real estate brokers in Dubai to explore these options and discuss the legal aspects. Feel free to contact us to discuss options you can explore for buying property in Dubai.